Mergers & Acquisitions

Services: Powering Your Growth Journey

Mergers and acquisitions are two highly significant commercial legal processes used as tools for achieving economic growth and expanding your legal and business knowledge.

M&A integration is one of the most powerful strategies you should master. So we work at TCMG focusing on meticulously preparing due diligence reports, drafting merger and acquisition deals to the highest legal standards, and reviewing agreements to ensure full compliance with legal regulations.

In this article, we’ll explore the core concept of M&A deals, their key differences, and real-world examples. Providing complete guide to mastering post-merger integration and the broader M&A advisor role.

What Does the Merger & Acquisition Strategy Mean for Companies?

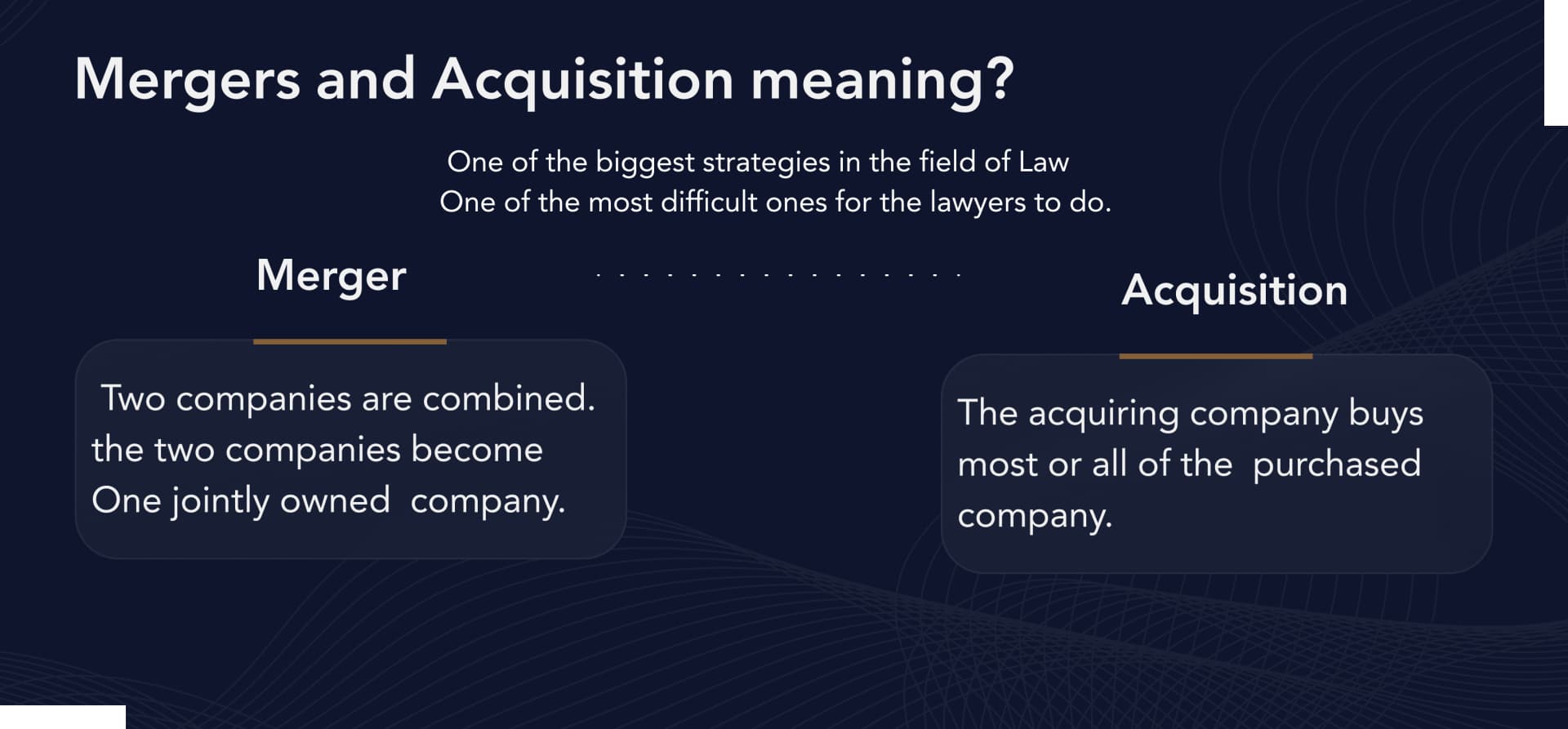

The M&A process involves a strategic business transaction where two companies combine their resources and operations. But mergers and acquisitions are distinct concepts with different outcomes.

In the merger: two companies unite to form a new, jointly owned entity. This typically happens between equal partners who merge their operations for mutual growth.

In acquisition: the acquiring company purchases most or all of the target company's assets. The acquired company may either be absorbed into the acquiring business or continue to operate independently under its original brand name.

Why do companies make mergers and acquisitions?

The M&A process is a very useful strategy, and because of that, many companies prefer to do it. Merger and acquisitions Companies do this process for a host of reasons, including:

Synergies: By integrating operations through M&A integration, companies can enhance efficiency, streamline processes, and reduce costs. Each company benefits from the strengths of the other, leading to a more competitive and profitable business model.

Growth Acceleration: Mergers and acquisition services provide acquiring companies with an opportunity to expand market share without having to build from scratch. Instead, companies acquire competitors in a horizontal merger, securing a larger share of the market.

Increase Supply-Chain Pricing Power: When a company buys out one of its suppliers or distributors, it can eliminate an entire tier of costs. Specifically, buying out a supplier is known as a vertical merger. By buying out a distributor, a company often gains the ability to ship products at a lower cost.

Eliminate Competition: Many mergers and acquisitions allow the acquirer to eliminate future competition and gain a larger market share. On the downside, a large premium is usually required to convince the target company's shareholders to accept the offer.

Improve the company’s performance: by increasing its value, decreasing costs, improving growth in earnings per share, and widening profit margins. This is the most intelligent objective of mergers and acquisitions.

removing excess capacity: A company absorbs another in its industry, so it can keep a check on production capacity and reduce it if necessary.

Choose one of our legal services in mergers and acquisitions.

How are companies valued during M&A?

The company valuation in the mergers and acquisitions services aim to put a dollar amount on a business by accounting for several factors and aspects of its operation. Two companies within the same niche that have the same market size may differ in valuation when you consider other aspects of business operation. There are some factors appraisers look at, including:

Stage of the company's lifecycle.

company history and reputation.

Observable growth.

Marketplace competition.

Prospects.

The cost for the buyer to build a similar business from scratch.

What are the advantages and disadvantages of mergers and acquisitions?

Everything in the world has a good face and a bad face, the M&A strategy is also so. We'll first show you the good face of merger and acquisition strategies.

The advantages of mergers and acquisitions

Improved Economic Scale: A new large company or a business that has acquired another company, its needs have increased. And when a company has high demands, it means it has a high purchasing power, enabling a company to negotiate a bulk order.

Enhanced Distribution Capacities: The M&A process may result in a company expanding geographically, which increases the company's ability to distribute goods or services to more people.

Increased Market Share: When a company acquires another company operating in the same industry, the new or larger company gets to enjoy a greater market share.

Improving a Product's Time to Market: A larger, more established company takes over a smaller one with a promising product. Smaller companies often lack the resources to quickly get their offering to market.

Acquiring Technologies and Expertise: A company buys a business because the merger and acquisition strategies cost less than it would to develop a technology, expertise, or product from scratch. Apple bought Siri for this purpose.

Do you think of doing an M&A process? Ask a lawyer from TCMG now.

The disadvantages of mergers and acquisitions services

As we said before, everything has a good face and a bad face. The following are some of the disadvantages of mergers and acquisitions:

Job Losses: When two companies doing the same activities come together and become one company, it might mean duplication and over-capability within the company, which might lead to retrenchments.

Diseconomies of Scale: Sometimes, mergers and acquisitions can result in diseconomies of scale. This can happen if the owner of the new, larger company lacks the control required to run a bigger company.

Higher Prices: A great market share is good for a business, but it can be bad for consumers. When a company has less competition and a greater market share, consumers tend to pay more for products or services.

Our law experts are aware of the advantages and disadvantages of the M&A strategy. Get your M&A Consultation to expand your business.

Cases of mergers and acquisitions

The world has seen lots of successful M&A deals cases. Big and famous mergers and acquisitions companies are always a great source of inspiration and a chance to learn from. Let’s discover the best and biggest (either by the deal size, strategic importance, or impact on the industry) examples of mergers and acquisitions as follows:

Vodafone and Mannesmann, $202.8 billion: This deal is known as the biggest merger and acquisition process of all time, mainly because of its value — $202.8 billion. A Britain-based Vodafone acquired a Germany-owned Mannesmann in 1999.

As a result, this largest m&a process enabled Vodafone to become the world’s largest mobile operator.

Dow Chemical and DuPont, $130 billion: Dow Chemical Company is an American multinational chemical corporation. In August 2017, the companies announced that they had successfully completed their merger. As a result, DowDuPont Corporation appeared. It is one of the biggest mergers and acquisitions.

Gaz de France and Suez, $180 billion: These two French national companies announced their merger in 2007. This transaction created the world’s fourth-largest energy company, which makes it one of the biggest global mergers and acquisitions companies examples.

Why is staying organized crucial in M&A due diligence?

Staying organized is essential for successfully navigating M&A due diligence. One of the most effective ways to do this is by using a virtual data room (VDR), where both parties can upload key documents for review. Our M&A Experts carefully analyze these files to ensure compliance, accuracy, and risk management.

At TCMG, our highly qualified data analysts create secure, encrypted virtual data rooms, allowing stakeholders to remotely upload and access essential documents. Our experts in merger and acquisition strategies conduct in-depth due diligence, ensuring that your M&A process moves efficiently toward a successful deal closure.

Contact with a lawyer from TCMG to get the best legal consultation.

Why choose us with confidence?

TCMG law firm is your trusted partner in Egypt and the Middle East. We can deal with all fields of law, including Corporate Law, Arbitration law, Tax law, and mergers and acquisitions strategies.

Our professionals have witnessed the strength of our office and our confidence in dealing with companies; that’s why we are qualified to offer you the best m&a consulting. You will find the following principles when dealing with us:

Customer satisfaction is our priority.

Quick legal solutions.

Keeping customer secrets.

Trust is our slogan.

We have unique legal specializations that require legal experience and a first-class strategic idea. We are proud to have lawyers who specialize in various fields of law, such as:

Tax lawyers

Financial lawyers

International lawyers

Arbitration lawyers

Real estate lawyers

Call us now at:

201276299998Email us at:

contact@tcmglaw.comConclusion

It’s clear to us from the article that merger and acquisition strategies are vast processes, and there is a lot to tell about them. They are very useful in the dynamic world of business; that’s why most companies prefer to use them instead of many legal strategies. We have also learned that they are not the same and discussed the differences between them. However, the world has seen a lot of successful m&a deals that are sources to learn from. We've tried to explain all that you need to know about mergers and acquisitions and provide you with every piece of information.

Don't waste your time thinking; start growing your business today with TCMG.

Subscribe to our mailing list and stay up to date!

Receive the latest news and legal services directly to your email

Subscribe now